Accruals Deferred Revenue Cornell University Division of Financial Affairs

As accrued revenues are identified during the closing period, they are entered into the system. Meanwhile, revenue accounts are reviewed to verify that there aren’t any unearned deposits that need to be recategorized as a liability. Commonly, this shift is tracked via a journal entry that debits regular revenue and credits the liability account. Though accrued revenue and unearned revenue are confusing to many, they couldn’t be more different.

- Every member has “reached” the advantage of having used the club for one month at the end of the first month of membership.

- A common scenario is for accrued revenue to be ignored, and deferred revenue to be recognized as a regular revenue.

- Assuming that all revenue is liquid cash can be a dangerous habit to get into, especially when less than satisfied customers start asking for refunds.

- For a common example, most insurance premiums serve as deferred expenses since the customer routinely pays at the start of the coverage period.

- To assume that all of your documented revenue is liquid can lead to unexpected shortages or financial pressure.

- When the bill is received and paid, it would be entered as $10,000 to debit accounts payable and crediting cash of $10,000.

The University of San Francisco operates largely on a “cash basis” throughout much of the fiscal year recognizing revenue and expense as cash changes hands. At year end, financial statements are compiled using the “accrual basis” of accounting. The accrual basis of accounting recognizes revenues and expenses when the goods and services are delivered regardless of the timing for the exchange of cash. The year end closing process is used to convert the books from a cash to accrual basis.

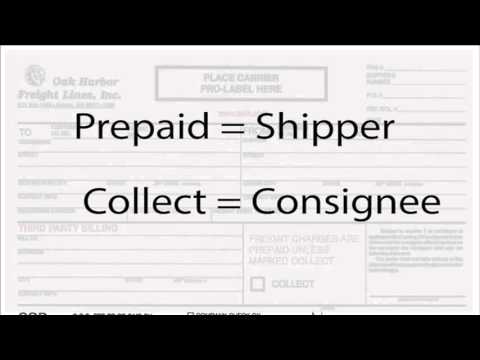

Аccrued revenue vs deferred revenue

Under the contract terms, the business may agree to deliver the service at the price of $1,000 and send an invoice at the end of the month, which is payable on the 15th of the next month. From that point until the end of the contract, the SaaS company will have $1000 in accrued revenue from that particular customer. Deferred revenue is most common among companies selling subscription-based products or services that require prepayments. Accrual is an adjustment made to accounts to make sure revenue and expenses are properly matched. Regardless of whether cash has been paid or not, expenses incurred to generate revenue must be recorded.

TMI Tax Updates – e-Newsletter dated: June 20, 2023 – with Direct … – Tax Management India. Com

TMI Tax Updates – e-Newsletter dated: June 20, 2023 – with Direct ….

Posted: Mon, 19 Jun 2023 18:38:07 GMT [source]

However, others may make a distinction between the two terms by referring to deferred revenue as money that has been received and unearned income as money that is expected but not yet received. From the customer’s perspective, deferred revenue provides them with certainty that they will receive the product or service they paid for. According to the revenue recognition principle, companies must recognize revenue when it is deferred revenue vs accrued revenue earned (i.e., when a good or service is delivered), not necessarily when cash has been received. Remember that accrued means to “add to,” so we have earned it but haven’t recorded it yet; deferred means we have collected the cash, but we haven’t earned it yet. No matter the strategy, accurately capturing both accrued and deferred revenues can at times be complicated—particularly when dealing with any delinquent payments.

Revenue

Deferred revenue refers to advance payments made by a customer for goods and services the company will provide in the future. It’s also known as unearned revenue; since the obligation has yet to be delivered, the payment hasn’t been ‘earned. Deferring revenue appropriately is a key component of revenue recognition for subscription billing. These are typically rated on a consumption basis, so the invoice for the utility can’t be issued until after the service period, often requiring payment at least a full month later.

For a common example, most insurance premiums serve as deferred expenses since the customer routinely pays at the start of the coverage period. Though accrued revenue represents revenue that you have earned but has not been paid for, it qualifies as an asset. However, it’s important to note that it is not as valuable as cash as it requires more effort to bill and convert into cash. Suppose that company ABC comes into an agreement with customer Y to deliver 24 pieces of machinery in a year.

Models in Software Development That Businesses Should Know

Then, in the subsequent fiscal year, we relieve the liability and recognize the revenue as the services are provided. A common example of this is Summer Housing deposits and Summer Camp registration fees. These fees are collected in the Spring (prior to May 31st) while the service (the camp or event) does not occur until sometime in the new fiscal year. Please contact the Accounting Department for the correct Banner FOAP number for deferred revenue items. Properly accounting for accrued revenue is essential for accurate financial reporting and forecasting. Most businesses accrue revenue and expenses as a part of their standard operations.

According to the accrual method of accounting revenue must be recognized in the period earned and related expenses… On August 1, the company would record a revenue of $0 on the income statement. On the balance sheet, cash would increase by $1,200, and a liability called deferred revenue of $1,200 would be created.

What is the opposite of deferred revenue?

Deferred revenue (also called unearned revenue) is essentially the opposite of accrued revenue.

برای نوشتن دیدگاه باید وارد بشوید.