Top 5 High Leverage Forex Brokers Canada 1:500 Leverage Brokers

Contents

The broker of your choice should ideally be available on devices running Android, iOS and Windows. So as to make sure that the standard of navigation won’t be reduced on mobile, please make sure the platform’s website is running under HTML5 coding. One of the foremost important steps before investing your money is to form sure that a Forex broker is legal.

The investors and traders decide that they are better off moving to another investment and selling off the poor-performing assets. Good examples of safer investments in this situation are fixed—income securities and gold. Some of the safe-haven currencies that many investors consider in the Forex market are the USD and JPY, which stand for United States Dollars and Japanese Yen respectively. The bid refers to the price or rate at which the trader can sell the asset or a currency pair. The ask price, on the other hand, represents the rate at which the trader buys that asset.

It does not matter if the broker offers all the best trading tools in the world. It also does not matter if the trading platform looks attractive. interactive brokers forex review None of these things are as important as top-quality customer service. When you’re trading a currency pair, that risk is sometimes amplified.

Educational tools

The trader needs to first understand the trend before making a trade. A proper understanding of the trend will help the trader to make the right choice when trading. It will also help the trader to manage his risks better. He will be able to make up his mind about when it is the best time to enter or exit a trade.

The Standard Account tends to appeal to medium term investors, whereas scalpers and day-traders tend to prefer the Raw Account. Canada has shown leniency towards receiving and sending money to and from international brokers and forex traders. The fx trading companies in the country adhere to all the anti-money laundering laws existing in the country.

- Check that the individual and firm selling the investment are registered in New Brunswick.

- If your credit card limit is set low or your trades are highly leveraged, one or more margin calls could max out your credit card.

- Because of this, the Forex market can be very active at any time of the day.

- The arrival on the web of this type of web sites has allowed a true democratization of FX trading.

- Additionally, the United States enforces very strict regulations on all international payments, especially because of threats to national security.

When you open this type of account, an experienced trader or a group of traders will trade your money along with the money of other investors. It’s important to understand that forex trading is a zero-sum transaction where one party profits and the other loses. Even knowledgeable and experienced investors can realize substantial losses when and if market conditions change. When it comes to forex brokers, you want to make sure that the broker you’re looking at is transparent and trustworthy. Though forex doesn’t require a lot of capital to start, you need to have at least a few thousand in the bank to make money. Check out our reviews for more information on the best forex brokers on the market.

So, make sure you register with a broker that offers easy communication channels. Before you register with a broker, find out if it offers competent and reliable technical supports. Some forex brokers can even assist you on how to open an account and make a deposit.

Market participants and Forex Brokers Canada

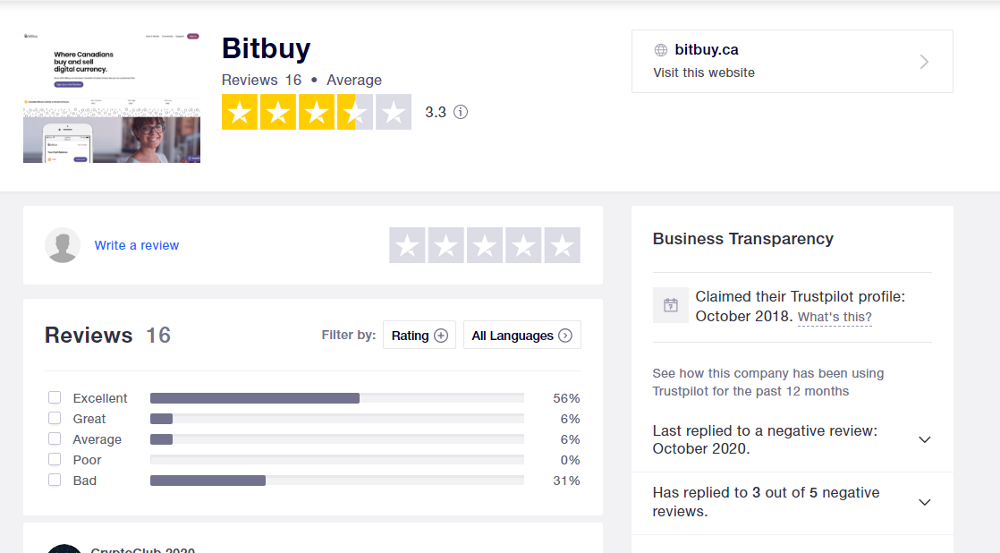

Before you choose any Forex broker in Canada, first read reviews about the broker. You can get reviews from the internet and it will help you a lot. The reviews can tell you if you should trust that broker or not. They will also tell you how the broker handles its customer’s needs.

It also involves speculation on diversity portfolio and geopolitical events. FOREX.com, part of GAIN Capital, is a forex broker regulated by the IIROC in Canada. FOREX.com offers 3,000 stocks, 1,000 stock CFDs, 80 forex currency pairs, and a wide variety of indices and commodities. Trade 55 currency pairs on fixed spreads, plus CFDs on crypto-currencies, stocks, indices, bonds and commodities.

You need to research their reliability and find out how trustworthy they are. A forex broker is a professional that provides a platform for trading Forex. They are also highly competitive among themselves with each of them claiming to offer the best service to the customers. Our platform provides adequate information to help forex traders in Canada. Both beginners and experienced traders can trust the information we provide towards making better trading decisions.

with an award winning broker

Another feature that Questrade offers, besides its large selection of paid market data packages, is the ability to get unlimited snap quotes. This is free real-time data for certain Canadian and American markets, including TSX, NYSE, and NASDAQ level 1 data, that is available with just one click. Many banks offer lower commissions for active ifc markets review traders and young traders. Bank brokerages typically charge $9.95 per stock trade, but you can get discounted or even commission-free trades with some online brokerages. If you have US dollar bank account in Canada and are looking to convert in your bank account at better rates than offered by your bank, then this service is for you.

There is a minimum standard test the broker must pass to even get a license. The trading platforms used for forex trading in Canada have advanced tools and plugins to pepperstone canada help traders access the market and analyze trends. The tools help them know where to take trading positions and when to exit the market, so they don’t run at a loss.

The regulatory agencies will help you to know if a broker is fraudulent or trustworthy. Many of the untrustworthy, fraudulent ones are not regulated. You should also find out if the regulation is by a tier-1 regulatory agency.

How does forex trading work?

Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. According to the Security Volatility Program from the Investment Industry Regulatory Organization of Canada , The following are the Margin requirements for each currency pair.

Forex Trading Canada 2023

USD/CAD, also known as the “Loonie” is Canada’s most popular Forex pair, but our traders also watch others including CAD/JPY, CAD/CHF, EUR/CAD and AUD/CAD. Start by checking each broker to make sure it offers the pairs you want. Next, check the spreads of each of the top Canadian Forex Brokers Canada to compare their offerings and determine where you’ll pay the least commission. There is a regular change in the values of the currency pairs and this creates opportunities to make a profit.

Why should you choose a regulated forex brokers?

Be the first to hear about the best offers, promo codes and latest news. To protect your capital and your long-term investing success, you should strive to keep your drawdown as low as possible. In addition, you want to keep an eye on your drawdown to evaluate the success of your trading strategies. You further declare that you read, understood and accept the content of easyMarkets Privacy Policy and you consent to receive market news and browsers notifications. In addition, there is no provision for an investor compensation scheme. Based on your selection, you will register for an account with EF Worldwide Ltd, which is authorised and regulated by the Financial Services Authority of Seychelles .

برای نوشتن دیدگاه باید وارد بشوید.